TaxWorld

Your new salary benefits

Congratulations ! Thanks to your employer, you now have premium access to myTax and myNeed.

ACCESS

Your personal space

Access your personal account to use your salary benefits. Your account is completely secure and your employer has no access to your data.

myTax

Save on average € 1.120,00

You don't think a statement is useful to you ? Take the test and you might be surprised !

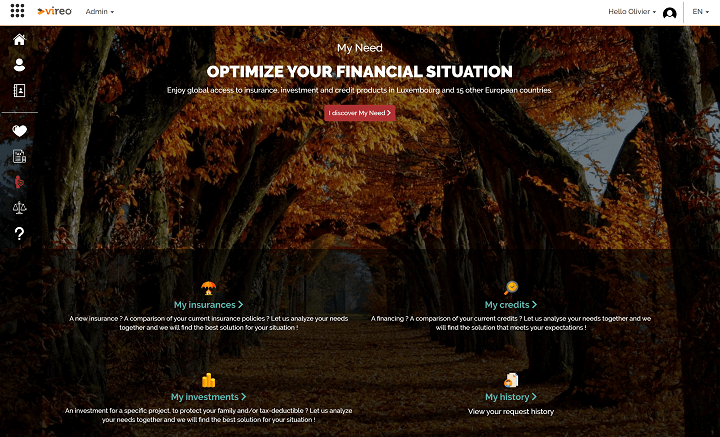

myNeed

Optimize your situation

Your wealth advisor offers you access to all insurance and credit products in Luxembourg and the neighbouring countries.

How does it work ?

Create your secure account

Go to my.vireo.lu and create your employee account using (depending on the explanations you received from your employer) :

- your professional email address, for example name@entreprise.lu

- your private email and the privilege code you received.

Rest assured your employer has no access to your personal data.

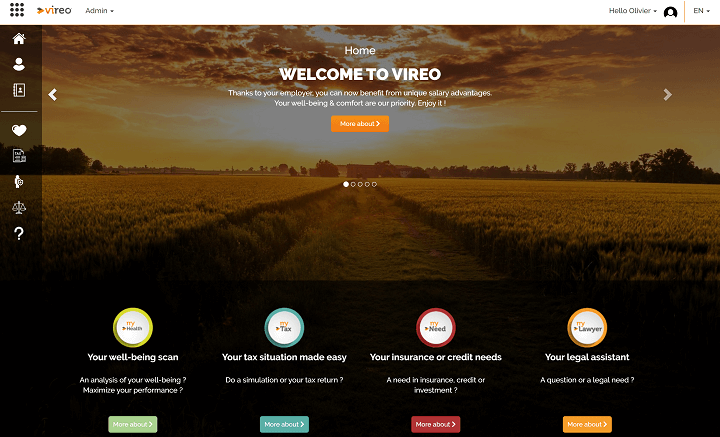

Access your personal space

Your personal account gives you access to your salary benefits.

You can now use myTax and myNeed freely.

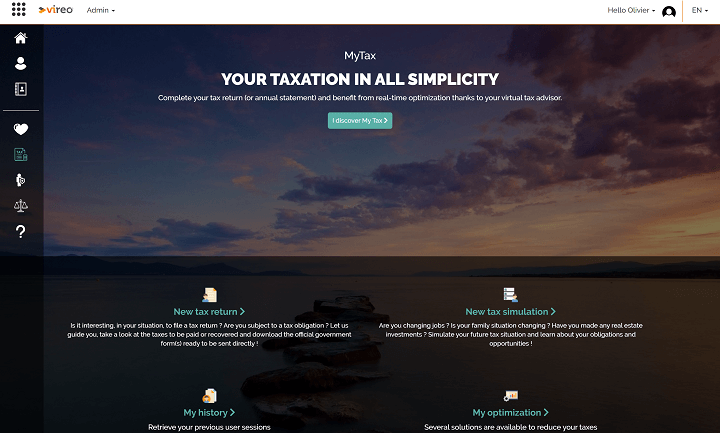

Complete your tax process with myTax

With no tax knowledge required, find out whether a tax return is mandatory or advantageous in your situation.

If so, myTax gives you a report showing you how much you should recover or pay back this year.

Download your forms fully completed & ready to send.

No time to do it all at once ? Resume your process at any time from the “history” tab in your personal space.

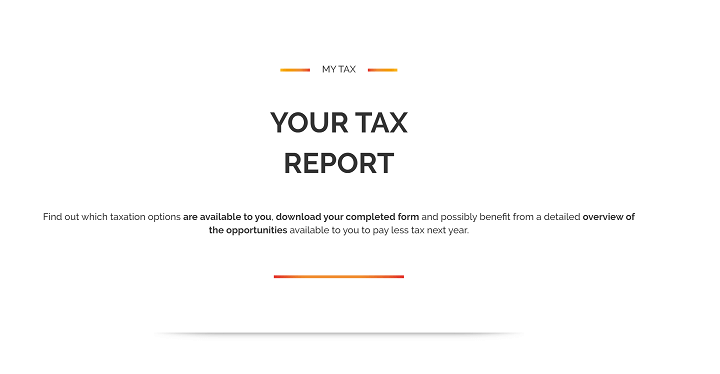

Find out how to pay less tax

The myTax report also gives you a personalized overview of the opportunities you have to pay less tax each year.

Apply for optimisation online and benefit from personalised services from your employer or our partner advisers.

Benefit from the services of a human advisor

Thanks to My Need, make an analysis of your needs online and benefit from the advice of an advisor to financially protect your family and optimize your financial situation.

We listen to you

FAQ

Although you use your professional email address, your employer does not and will never have access to the data encoded in your personal space.

The protection of your data is of utmost importance to us. This is why our platform is subject to the highest standards in the market for cyber security.

Good news for both you and us : Edonys has obtained official certification that our platform meets the highest requirements in terms of IT security.

This is a very good question and myTax will answer it very quickly and simply.

Just follow the process and at the end myTax will give you a personalised report telling you whether :

- it is mandatory for you to make a tax return

- or if it’s advantageous in your situation to do so. You may be able to recover an amount of tax that was overpaid from your salary…

If you owe or have an advantage in making a tax return, myTax will tell you the tax options available to you. All you have to do is download your fully completed form and :

- either send it to the tax authorities on myGuichet.lu

- or print it out and send it to the tax authorities by post.

Let myTax be your guide. If you are not obliged to make a declaration and if it is not advantageous for you, myTax will obviously recommend that you do not make one.

Most of our users were convinced that they did not have to make a return. And yet they have recovered an average of € 1.120,00 each year. Thank you myTax !

myTax allows you to make your tax return without any required knowledge. You simply need the necessary documents that myTax will ask you for during the process.

Yes, all situations are handled.

myTax is aimed at all employees, whether you are a Luxembourg resident or not and regardless of the complexity of your situation (Luxembourg and foreign income, real estate income, income from movable assets, transfers, etc.).

myTax is used and validated by renowned tax experts in the Grand Duchy of Luxembourg, you can trust it completely.

In fact, some fiduciaries use myTax to train their employees.

You don’t have to pay anything to use myTax and myNeed. Your employer has taken out a subscription giving you premium access to these two salary benefits.